7 Indicates Seniors Is always to Prevent Wasting Profit Senior years

Content

- Brucebet.nz click for more info | Suze Orman: It Unusual Way of Strengthening Money You are going to Alter What you When you’re Sick of Lowest Productivity

- Finest Local casino To try out That it Slot the real deal Currency

- Greatest Web based casinos Bonuses

- Homeownership has been ‘okay’ for Boomers… and their infants tend to luck away too

The new Boomers’ desire to safeguard the liberty has already been producing a greater you desire for custodial care functions where someone help in the home. Members of which generation is to purchase far more in the-home care devices, such as scientific alert options, hearing aids, and you may electronic procedures dispensers, also. The former hippies would be less likely to chat away today than Millennials who are much more modern on the personal items. Seniors thrived to your giving support to the entire members of the family unit which have an excellent married number of moms and dads while Millennials is actually shorter concerned about taking hitched and much more likely to support homosexual marriage. They’re also more likely to secure the legalization away from cannabis and therefore are less likely to be religious. Generation X adopted the newest Boomers, and were followed by Millennials.

Brucebet.nz click for more info | Suze Orman: It Unusual Way of Strengthening Money You are going to Alter What you When you’re Sick of Lowest Productivity

Baby boomers along with, typically, features a much huge share of the nation’s riches than millennials when they were a comparable years — 21 % compared to millennials’ 4.6 per cent. GOBankingRates works with of many economic entrepreneurs to reveal items and you can functions to your audience. These labels make up me to promote items inside the ads round the our very own webpages.

Finest Local casino To try out That it Slot the real deal Currency

Yourdon was not the first inside her family to receive economic help to possess a current household purchase. Her sibling has also been offered money to cover a down percentage on the a home, and this Yourdon known as one of the greatest difficulties against younger adults seeking become home owners. For these reasons, boomers have been finest create to accumulate the fresh wide range that they’ve gathered now.

The remaining count originates from private companies in the $17.step 1 trillion. Americans have approximately $156 trillion inside property, based on Visual Capitalist, however, half of you to definitely money — $78.step 1 trillion — belongs to the middle-agers. Others are spread out around the Age group X, the fresh Hushed Age group and you can Millennials. Along with soaring food and homes costs, today’s young adults face other economic demands its parents don’t at this many years. Not merely are their earnings down than simply their moms and dads’ earnings after they was inside their 20s and 30s, once modifying for rising prices, however they are along with holding large education loan balances, recent reports inform you. Should your Koncaks’ struggles having health care will set you back since the older adults sounds familiar, it’s since they’re.

Greatest Web based casinos Bonuses

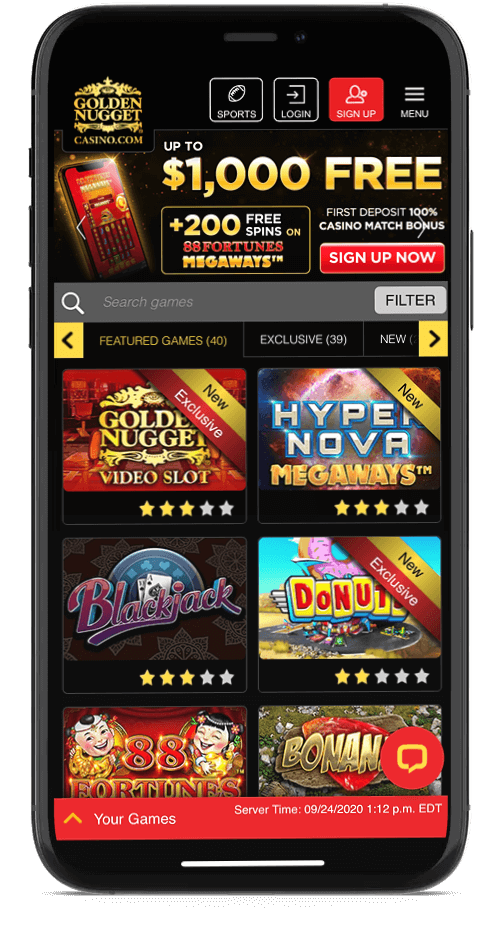

When you’re keen on online slots and looking to possess a great games that can make you stay amused throughout the day, take a look brucebet.nz click for more info at the child Bloomers position. That it fascinating games is filled with colorful picture, fun animations, as well as the opportunity to winnings large honours. In this article, we’re going to dive on the why are the baby Bloomers slot thus special and just why it is vital-play for one position partner.

Open and you may sincere communications play a life threatening role whenever helping Child Boomers browse monetary intricacies, especially at the beginning of later years. Which have old age, per age bracket provides various other priorities and you may pressures. The newest rising cost of living cost were determined playing with SmartAsset’s rising prices calculator. “Whatever you’d wear your own insurance policies your’ll want to allege since the a secured asset,” Mazzarella said. With regards to the latest S&P CoreLogic Instance-Shiller List, home values were 16.6 per cent higher this past Can get compared to 12 months previous, the largest get in the thirty years. Shorter metropolitan areas in particular have begun to see volatile development, with folks more often getting off the fresh shores and to the smaller urban centers — and in turn riding upwards home values.

Homeownership has been ‘okay’ for Boomers… and their infants tend to luck away too

Individual durables owned by seniors are worth $2.98 trillion, while the individual durables belonging to millennials pile up to a property value $step 1.55 trillion. Retirement entitlements make up ten.8% of your millennials’ wealth, 17% is tied various other property, eleven.8% in the individual durables, 12.7% independently organizations and you will 5.5% inside corporate equities and you can mutual finance. Inside the 1998, the fresh American populace under 40 years kept 13.1% from The united states’s complete riches. Consequently millennials and Age group X own less than half of one’s wide range one older generations had once they were the brand new same decades. Each other sets of boomers generally have loads of retirement discounts, nevertheless top middle class is more apt to be getting getaways and possess a bit more discretionary money. Following, needless to say, we want to deduct your debts, as well as mortgages, car and truck loans, unsecured loans, credit card debt, money owed to the a corporate ordered otherwise sold and you will right back taxes, to mention a few.

They just have to open the internet internet browser the spot where the Adobe Flash Plugin are designed to initiate the overall game. The regular icons mode effective combinations of the identical pictures. All of them set near to one another from the same effective spend range from left so you can right.

We fool around with analysis-inspired methodologies to evaluate borrowing products and you may services – our ratings and reviews commonly dependent on advertisers. You can read a little more about our very own article direction and you can the issues and you may characteristics review methodology. Riches is typically gathered in the form of discounts, investment, or any other types of property, in addition to a house. The brand new Government Set-aside actions just how much wealth try accumulated from the for each and every generational age group inside the totality.

Retail arbitrage comes to likely to places — such as Large Plenty, Burlington, Address, Investor Joe’s, Walmart, Marshalls, Ross and you may TJ Maxx — and buying discounted items that you might resell on the web to have a good cash. Because the Director from Blogs in the TheCelebrityCafe.com, Angela added an international group based in Tokyo, innovating the brand new site’s content means and you can launching a profitable internship system one cultivated growing talent. As they age – and you may bequeath – the brand new ensuing “Silver Tsunami” tends to pass on what Freddie analysts is actually getting in touch with a great “Wave from Wide range” because of their pupils and other heirs. In the Child Bloomers, might paytable consists of 5 reduced-using and you will step three high-paying symbols. The brand new higher-spending symbols are created while the a bunny, a little sheep, and you may a good duck. All the payouts are calculated from the type of indexes of 2x in order to 1000x.

- To construct as often — or even more — wide range since the boomers, more youthful generations will have to make use of compounding attention.

- The infant Bloomers position have a premier RTP speed, offering players a fair danger of winning.

- While the amount your arrive at once subtracting expenses of property will give you a concept of their classification, the truth is that you happen to be able to real time far more or shorter luxuriously centered on your geographical area, Mazzarella told you.

- Note that not all says allow it to be notary signing agencies to assist romantic money and may provides other limitations.

![]()

Because the millennials tackle rising home values due to popular and you will restricted also provide, he’s to shop for home reduced frequently and soon after than just generations just before her or him. Millennials ought to be considering installing a home plan. They are aware a lot better than anyone that unforeseen events may appear from the any moment. Starting at the very least a simple Faith or Usually provide a reassurance with the knowledge that debt points are dialed inside the, however if some thing happens. Inside the 1989, 40-year-old boomers got an average money out of $70,100000, average wealth of $112,one hundred thousand and you may average personal debt of $sixty,100. In contrast, millennials have significantly more personal debt according to its earnings and gathered wide range.

Millennials had been created ranging from 1981 and 1996, and are already aged anywhere between 25 and 40. Baby boomers had been produced anywhere between 1946 and you can 1964, and they are currently aged anywhere between 57 and 75. As a result, the key wealth transfer from middle-agers in order to younger years you to scientists has forecast may possibly not be delicious after all, as often of older Americans’ currency would go to healthcare. GOBankingRates’ article people try invested in providing you with unbiased reviews and you can suggestions.

Because the boomers enter into later years, they must be contemplating how they can service young generations. Building generational wealth will take time, however, listed below are some means younger generations you will get caught up to help you baby boomers. Of baby boomers nonetheless functioning, the newest median amount of deals they think it’ll have to become economically safer within the later years is $750,one hundred thousand, according to a survey held by the Transamerica Cardio. But not, an average worker in this generation has stored merely $202,000. You can believe Gen X had it a lot better than people most other generation.

To simply help painting the picture, let’s define just what millennials don’t features. Centered on Bloomberg, millennials simply hold 4.6 % of one’s wide range in the us. He’s 10 minutes richer than simply millennials, and you will doubly rich than Gen X. Yet not, research out of prior years signify the brand new pit shouldn’t end up being as large as it is now. As well, millennials are having to wait considerably longer to the wealth wave to make, where it’ll start to inherit money using their parents.

お問い合わせ

お問い合わせ